INN Index 2022: Enduring in crisis, surging in local communities

Multiyear Revenue Growth

Industry observers speculated whether the nonprofit news field’s revenue growth in 2020 represented a blip – a short term injection of capital to help public service journalism survive a crisis year. The data show this is not the case.

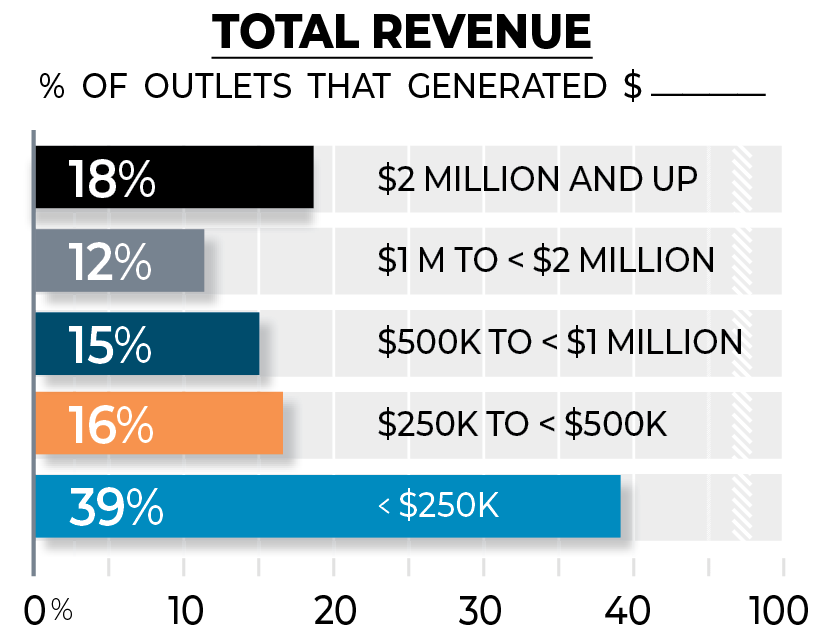

In fact, revenue totals reflect a field that continued to grow throughout 2021. The nonprofit journalism sector weathered the worst of COVID-19 without retrenching, and total fieldwide revenue and staffing figures grew from 2020 to 2021. The core group of digital-first, independent publishers came in at an estimated $400 million for 2021, representing growth from the $300 million to $350 million reported out of this subset the previous year.

Revenue growth from 2020 through 2021 can be understood on two fronts. First, several global and national outlets grew foundation funding significantly during this timeframe, driving up both total revenue for the field and the share of total revenue attributable to foundation support. Broader trend data over the past four years (2018 through 2021) show that this revenue growth is sustained over time: Two-thirds of news outlets in the Index trend set increased their total revenue, with a median of 25% growth in total revenue during this four-year timeframe.

Second, newly launched outlets generated new revenue counted in 2021’s totals. Jump to the section on local news for more information.

A closer look at the ebbs and flows of the sector’s major revenue streams (foundation funding, individual giving, and earned revenue) provides a more nuanced understanding of the field’s financial health: Foundation funding remained constant overall while increased for larger outlets, earned revenue was the most volatile, and especially for locals, and individual giving grew for all types of outlets.

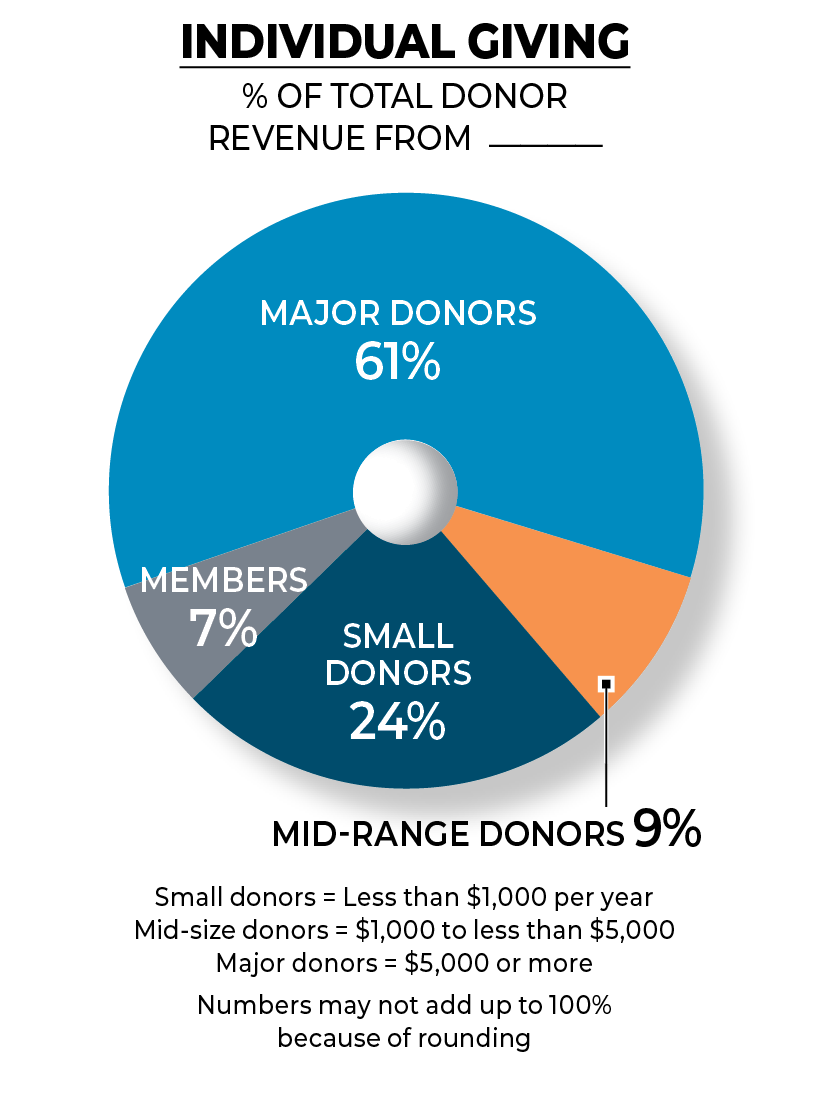

Individual giving growth spans the field

A look at the last four years shows individual giving is a relatively well-dispersed and stable revenue stream for nonprofit news. Individual giving is an umbrella term that encompasses financial contributions from individuals.

Total individual giving to our Index trend set grew 53% over a four-year period, from more than $31 million in 2018 to more than $48 million in 2021, with a median increase of $37,000 per outlet.

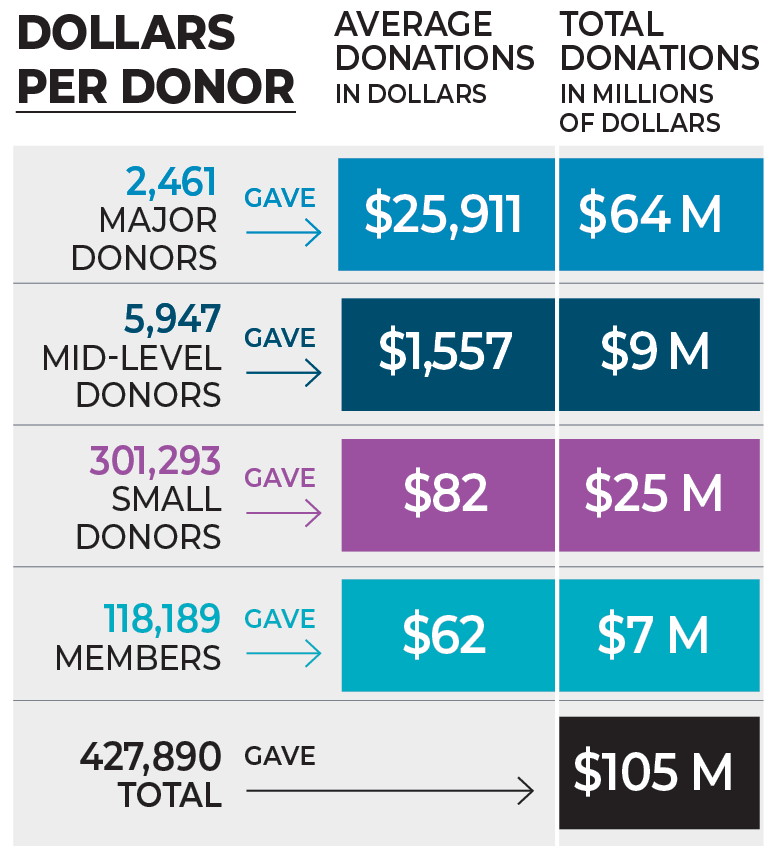

The increasing numbers of people donating to nonprofit organizations is the major factor driving up individual giving revenue, rather than increases in median gift amounts, which largely held steady year over year. More than half (59%) of the Index trend set grew the number of major donors, with the median growing from 2 major donors in 2018 to 3 major donors in 2021. The number of small-dollar donors and members also grew: over three-quarters of outlets in our Index trend set reported increases, with the median growing from about 250 contributors in 2018 to roughly 550 small-dollar donors and members in 2021.

Wisconsin Watch illustrates long-term individual giving growth, increasing $100,000 in revenue from about 350 individual donors in 2018 to $280,000 in revenue from over 700 donors in 2021. Jay Burseth, Wisconsin Watch’s development director, points to new, small-dollar donors attracted by expanded coverage and higher gift amounts from several mid-level donors as key drivers of this revenue growth. By the end of 2021, about half of Wisconsin Watch’s individual giving revenue came from major donors, with the other half from mid-level and small-dollar donors. In 2022, Burseth is focused on retaining and growing the outlet’s Watchdog Club, its group of individuals, families and corporations giving $1,000 per year.

All types of outlets reported individual giving growth over the four-year period, with about 7 in 10 local, state or regional, and national or global outlets in our Index trend set reporting gains. National outlets grew individual giving the most – the median growth of individual giving dollars to national outlets was more than 60% in the last four years – compared with local outlets (30%) and state and regional outlets (40%). Index data doesn’t indicate why national organizations had the most success growing individual giving dollars over this timeframe, but INN’s work in the field points to a possible cause: larger, national and global outlets are likely to have dedicated personnel designing and managing individual giving programs.

Individual giving also proved to be a reliable revenue stream for nonprofit news through and beyond the 2020 crisis year, with most news outlets retaining the new dollars and donors brought on in 2020. By the end of 2021, median individual giving revenue per outlet was at $79,000, consistent with 2020’s $75,500 median. This roughly lines up with performance across the nonprofit sector broadly – Giving USA reports a 4.9% increase in giving by individuals from 2020 to 2021. See our 2021 Index Report for more on the swell of individual giving dollars to nonprofit news during the 2020 crisis year.

Of the three levels of individual giving, small-dollar contributions are growing fastest. Over the four-year period, nearly 80% of outlets in our Index trend set increased small-dollar donor or member revenue and half at least doubled small-dollar donations. The median increase in small-dollar donations per outlet was $24,000. INN’s Index data doesn’t point to a cause of this collective revenue growth, but our reporting indicates a combination of factors – including retaining existing small-dollar donors, upselling major and mid-level donors, and bringing on new, first time donors.

PublicSource, a local news site in Pittsburgh, identifies matching opportunities as the secret to keeping individual donors energized and motivated to give from 2020 through 2021. Membership and Development Manager Alyia Paulding works to build match pools throughout the year, leveraging skills she practiced through NewsMatch to translate pooled support from the outlet’s board and existing foundations into new, small-dollar donors.

One driver of individual donations is NewsMatch, the largest collective fundraising campaign for nonprofit news. News outlets use NewsMatch to incentivize individual giving and local funder contributions. In 2021, a nearly $4.1 million match pool from national funders was leveraged to generate more than $42 million from individual donors and $4 million in additional match funds from local foundations, businesses, and major donors. This number of local match funders nearly tripled from the year prior.

Foundation funding, earned revenue sources remain variable

Foundation funding for the Index trend set largely held steady. More than half of outlets reported increases in foundation funding over the four-year timeframe. The median increase for the whole group over a four-year period was more than $45,000, a nearly 40% increase. About one-sixth (16%) of outlets retained foundation funding at steady levels and more than one-fourth (28%) reported decreases.

INN’s Index data doesn’t point to a cause of foundation funding increases, but our reporting indicates a combination of factors: The successful cultivation of larger gifts from existing funders and new, restricted foundation funding to support specific beats or initiatives of interest to issue-based grant-makers were behind many foundation funding spurts for the cohort of larger, national and global outlets. For several state and local news outlets, multiyear support from the American Journalism Project made up the bulk of foundation funding gains, especially from 2020 to 2021.

The Narwhal’s Emma Gilchrist pointed to a unique reason for foundation funding gains for the Canadian newsroom: a new status in Canada allowing registered journalism organizations to accept grants from charitable foundations. Such a move will continue to open new foundation relationships for Canadian nonprofit news outlets and likely spur growth of nonprofit journalism in the country. “The nonprofit news landscape is in its infancy in Canada, but I think this new status is going to encourage more to go the nonprofit route,” Gilchrist said.

Grantmaking to nonprofit news remains concentrated in larger, national and global outlets. Jump to the foundation funding section in Challenges & Opportunities to learn more.

Earned revenue was the most volatile revenue stream year over year, especially for local news outlets, most likely a pandemic effect. Across the Index trend set, about half of outlets reported an increase in earned revenue, and more than a third experienced decreases. Median earned revenue for local outlets dropped in 2020 and again in 2021 to just under $29,000 per outlet, lower by nearly a third than the pre-COVID the level. Jump to the earned revenue section in Challenges & Opportunities to learn more.