Chapter 1: Audience Goals

By Emily Roseman, Jesse Holcomb, Ha Ta and Michele McLellan

The nonprofit news difference

In a media ecosystem built on and measured by consumer attention, pageviews and clicks, it’s not looking good for news outlets: From 2020 to 2023, the percentage of traffic to news websites driven by social media has been cut in half. Fewer people are closely following the news, news avoidance is up, and consumers are shifting their news habits. Small local shops, public broadcasters, local TV and even The Washington Post are in a state of changing and often declining audiences. Web traffic is in flux for nonprofit outlets, too.

Within this tumult, nonprofit, independent news outlets emerge as a key point of difference.

While many commercial media models hinge on identifying, serving and maximizing audiences with a high ability to pay for the product —or maximizing audiences and selling their attention to advertisers — a key part of the nonprofit mission often includes serving audiences and covering topics not traditionally seen as revenue generators. The nonprofit model allows these news outlets to recenter their primary mission around their defined goals and impact first, profitability second — letting these organizations spend time and resources on the costly, time-intensive work of uncovering corruption, producing deep explanatory reporting, and connecting a community.

Let’s get down to brass tacks, though: News outlets need audiences. Nonprofit news outlets are not immune from the business of capturing and growing audiences. So how are these organizations growing and measuring their communities served? INN will release additional findings in the coming weeks: Chapter 2 will cover third-party audiences reached by republishing partners, Chapter 3 will dig into direct audience growth tactics, Chapter 4 will discuss how outlets are tracking and measuring their audiences and impact, and Chapter 5 will review marketing tactics.

This chapter begins where all audience strategy should start: the organization’s goals.

This chapter focuses on audience goals as standalone factors to be examined but also uses INN members’ self-reported goals as filters for understanding other audience trends, including direct audience growth. For example, it explains how a news outlet’s goal of serving a specific audience (rather than a general one) might impact web or email audience size. This chapter mostly focuses on nonprofit news’ audience goals and how they vary across the sector.

| The nonprofit tax status doesn’t indicate high-quality journalism or editorial independence, but the INN standards filter does. To become an INN member, an outlet must demonstrate editorial excellence, editorial independence, and transparency in funding. Throughout the 2023 calendar year (CY2023), only 48% of nonprofit newsrooms that applied for INN membership in 2023 were accepted. Jump here to read the shared standards of INN members. |

Balancing audiences

All news outlets in the INN network are united by high quality journalism, financial transparency, and editorial independence. But nonprofit news outlets often tackle different parts of an interconnected problem. Previous Index reports cover how the geographic scope of an outlet’s coverage (local, state, or national) impacts its revenue portfolio and standard capacity — and the same can be said for the outlet’s audience strategy and size. Trickling down from the organization’s reason for operating come audience goals, or who the outlet aims to reach or serve, how many people, and by what means.

In 2023, 6 in 10 organizations focused primarily on in-depth, time-intensive news, including investigations and explanatory reporting.

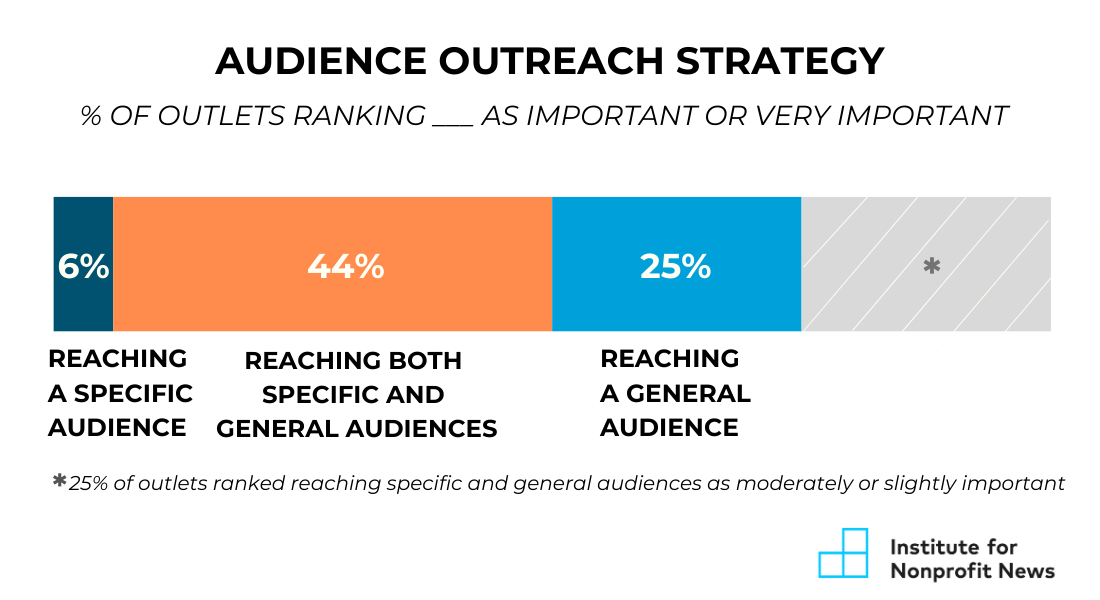

Many nonprofit news organizations try to balance their public service mission of creating open and accessible journalism while also defining target audiences for their work. In INN’s survey, 44% of outlets rated serving both general and specific audiences as important or very important objectives. Smaller cohorts in INN’s sample focus on targeting specific audiences (6% of outlets) or getting their coverage into broader, general audience streams (25% of outlets).

Target audiences typically start with groups connected to the outlet’s mission or impact, including groups defined by geographic areas, race or ethnicity, specific interests like climate or education, or power and influence. Target audiences often also include groups likely to become paying members or subscribers. The central audience challenge of the nonprofit news outlet is to determine the right portfolio of audiences that centers the outlet’s intended impact and mission while being in sync with the outlet’s means of sustainability, including small-dollar donations and grants.

Although Index data doesn’t explain how organizations are striking this balance, INN’s reporting and work in the field show that many nonprofit outlets will adopt a tiered approach to their audience strategy: defining their primary objective as creating coverage “for” a specific group and their secondary objective as “about” a group to provide information to policymakers or interested community members.

For example, Borderzine, a national outlet focused on providing relevant coverage for the areas surrounding the U.S.–Mexico border, describes their audience portfolio like this: “Audiences we target include regional audiences to help inform on issues affecting our communities, and broader national audience interested in learning about the U.S., Mexico border region and Latino communities. This audience values genuine cultural understanding and needs verified, informative reporting on topics of public interest.”

Similarly, Barn Raiser says their primary target audience is composed of two groups of people: “One is civically engaged people who live in rural and small-town America and who read news online. The other is civically engaged people who don’t live in rural America but have an interest in understanding the challenges facing rural and small town communities.”

Jump here to see more examples of how INN members define their target audiences.

What we see in the Index data is that typically, the larger the outlet’s geographic scope (national or global versus local), the more targeted the audience plan. While local outlets are highly focused on audiences defined by the geographic bounds of their communities, state or regional and national or global outlets are more apt to target audiences defined by demographics or a specific topic.

The organization’s coverage priorities also drive the scale of audience targeting. Outlets that focus on producing explanatory journalism are more likely to value specific audiences that are interested in a particular topic, while their counterparts that emphasize investigative reporting or current news tend to put a higher priority on attracting broad, general audiences.

| A note from INN’s audience team: Nonprofit organizations of varying missions exist, in part, to cover critical needs of a community that the market has failed to produce. Nonprofit news organizations are no different. It is clearly reflected in how they articulate their target audience and then attempt to strike an appropriate balance. Sam Cholke, INN’s manager of distribution and audience growth, discusses how some nonprofit news outlets are striking this balance. |

Who nonprofit news outlets serve

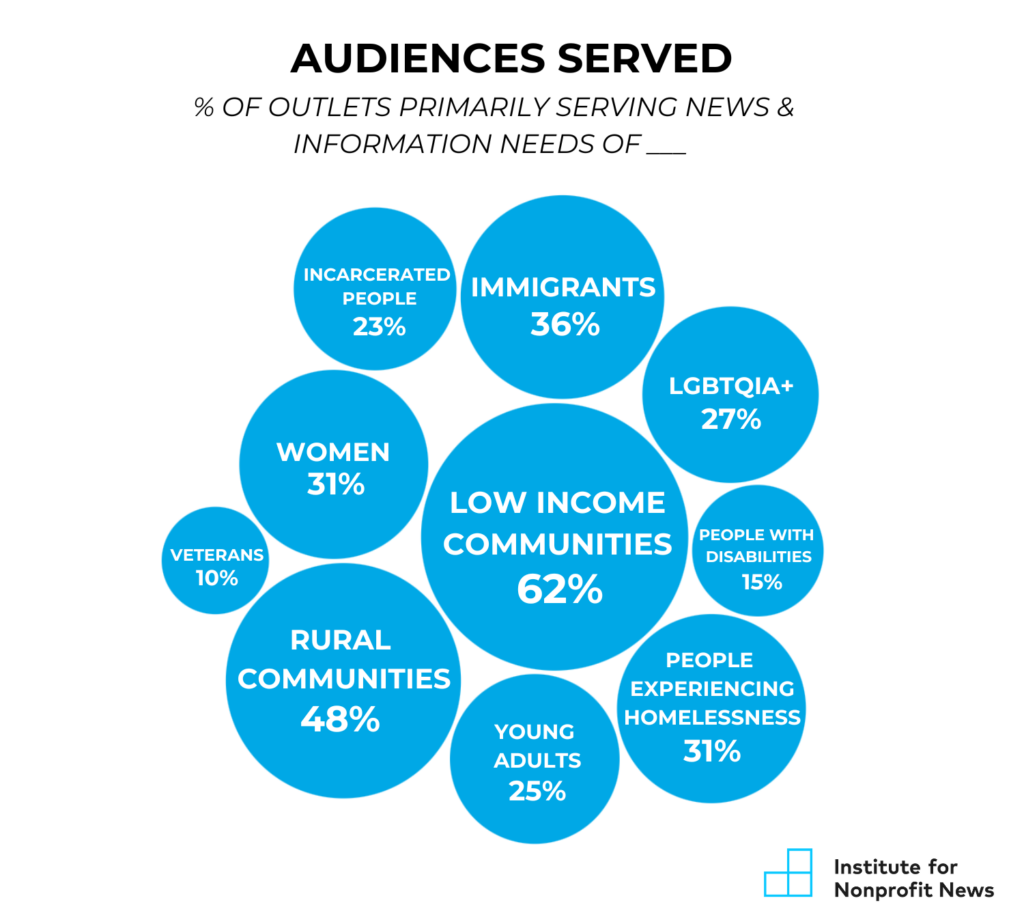

About half of all surveyed outlets (51%) said they focus primarily on serving the news and information needs of an underserved community. These organizations most frequently cite low-income, rural and immigrant communities as their audience focus, reflecting trends from last year, too.

INN asked a separate question specifically about serving communities of color and found that about a fifth of INN outlets, or 73 outlets surveyed, focus primarily on meeting the information needs of communities of color. People of color comprise a majority of the respondents’ audience, and their organization spends most of its funding, resources, and staff time on stories for people of color.

Such audience priorities have significant implications for the audience engagement and growth options members of the INN Network see as mission-aligned, how they appear to be responding to external pressures like the decline of social media referrals, and the incentives organizations are responding to when setting strategy.

For example, INN members serving communities of color or other groups historically excluded or harmed by media organizations often use audience engagement strategies that might seem untraditional to some, including text messaging, community events, partnerships, WhatsApp groups and print newsletters. INN reported on a few examples of this in its 2022 Q&A series, How nonprofit newsrooms serve communities of color, including how the Dallas Free Press uses text messages and community events to engage with bilingual communities in the West Dallas neighborhood, and how Charlottesville Tomorrow partnered with a local magazine to reach new audiences.

INN’s work in the field shows that these types of audience engagement and growth strategies are often more costly, carry higher risk, and involve more complex distribution strategies that require more staff time and expertise. Indeed, staff time and financial resources emerged as the top two most common barriers organizations in the survey face in their efforts to grow and engage with audiences. Nearly half of the survey’s respondents cited staff time as the primary barrier, and a little over a quarter reported financial resources. Less common primary challenges included organizational strategy and planning, staff knowledge and skills, and attracting and retaining staff.

Overall distribution strategy

How are outlets defining their focus on either building direct audiences via their own platforms, like web or email newsletter, or reaching third-party audiences? Similar to how nonprofit outlets determine their balance of general vs. specific audiences and how they define who they serve, nonprofit outlets must craft the right distribution approach to match their mission.

Third-party distribution includes distribution through another outlet’s digital, broadcast, or print channels, either for free or for a fee, and can also include using news aggregator platforms (like Apple News or Smart News) or syndication platforms.

Survey data show the geographic scope of an outlet’s coverage and its age often dictate the organization’s audience and distribution strategy.

- Local outlets produce coverage for a single city, county or metro area, or even a cluster of neighborhoods or towns. They usually focus on serving a population of 100,000 or less. Nearly all local outlets (9 in 10 outlets in 2023) focus on reaching audiences through their own direct platforms, mostly over the web. For local outlets, focusing on direct distribution makes sense: Many operate in areas without other sources of high-quality news that might be potential content sharing partners. At the same time, local outlets are finding success with building revenue from direct audiences (including small-dollar donor giving and earned revenue), so it’s a distribution strategy that works with both mission and sustainability.

- Startups: 76% say they primarily reach audiences over direct channels. This could reflect a shift of strategy for nonprofits, but likely also reflects that most startups are local and tend to have this direct audience priority.

- National and global outlets typically focus on investigative or explanatory reporting and target audiences of multiple millions of people with their coverage. They rely on third-party distribution — partnerships with other news sites, print publications and public radio — to reach audiences beyond their own platforms.

- News organizations that focus on a single topic (13% of all nonprofit outlets) are twice as likely as the rest of the field to rely on partner publications to distribute their journalism. In all, 55% of single-topic outlets say they either rely primarily on this third-party distribution or employ a roughly equal mix of direct and third-party distribution to reach their audiences.

Audience growth goals

Despite varied missions and distribution strategies, nonprofit news organizations seem to be heading in a similar direction: investing in growing audiences via their own platforms (including their website and newsletters). When asked to rank their top audience goals, the two most popular responses were increasing overall website traffic and email newsletter subscriptions, winning out over social media engagement or reach, paid reach, third-party distribution, and other engagement metrics.

Almost half of respondents ranked increasing traffic as their top (33%) or secondary (15%) audience goal. Another 16% listed increasing email newsletter subscriptions as a top goal, with 30% ranking growing newsletter subscribers as their second goal. The third most popular audience goal selected was to increase donations or engage audiences that can be converted into paying contributors: 21% listed it as their top goal; 19% ranked it as their second.

At the outlet level, INN’s data show that organizations tend to select primary audience goals based on where there was room for improvement. A third of outlets indicated their top audience goal was "increasing overall traffic to websites or other products,” and this cohort reported less web traffic (as measured by average monthly uniques or AMUs), reporting nearly half the mean AMUs compared to the full survey sample. Outlets with web traffic growth as their primary goal tend to be state or regional in focus.

Following a similar pattern, about a fifth of outlets (21%) indicated engaging audiences that can be converted into paying contributors as their top audience goal, and this cohort reported lower individual giving revenue than their peers. Outlets with monetizing audiences top of mind tended to be local, more likely to prioritize daily news, and more likely to be a smaller-budget organization.

Member insights

INN reached out to several outlets to better understand why they’re focusing on particular audience growth goals and what these goals look like in practice.

Sierra Nevada Ally, an outlet based in Reno, Nevada, that covers the environment, civics and culture, is focused on growing web traffic in 2024. Pandemic spikes in their audiences have eased, but the Ally's Google Analytics dashboard doesn't tell the whole story. Like many outlets during the COVID-19 pandemic, the Ally reported a spike in web audiences. Yet this traffic, largely from opinion pieces, wasn’t the type of audience co-founder and Publisher Joe McCarthy felt was consistent with the publication’s mission. The Ally’s board of directors and staff felt the same. So in 2022, they decided to move away from opinion pieces and return to their core values: civics, climate, community and collaboration. While they still publish some essays, the shift back to the Ally’s core journalism mission has adjusted their audience size back to pre-pandemic levels. McCarthy said even though provocative opinions had increased readership, they’re very comfortable being more focused on their mission and excited to use a new Press Forward grant to reach even more readers that are often overlooked.

In 2025, the Ally will focus on audience growth while sticking to its mission and increasing outreach to communities that lack news access, including the area’s Latino and Indigenous populations.

| What does Sierra Nevada Ally’s focus on growing web audiences around the four C’s — civics, climate, community and collaboration — look like in practice? For civics, they’re moving away from breaking news and politics. “We are not going to cover breaking news unless it truly has a story behind it. That’s part of the shift,” McCarthy said “We’re doing less chasing down specific day-to-day stuff and working more on long-form journalism.” Along those lines, the Ally recently published a voter guide they update daily. “We're helping our voters be able to make their own decisions,” McCarthy said. “So we drive traffic to each one of the races, folks can visit each one of the candidates, websites and or Facebook pages and Twitter pages and wherever else they're trying to attract potential voters.” |

Other outlets, like NextCity, have turned their focus to converting their existing loyal audiences into small-dollar donors. Executive Editor Lucas Grindley points to lessons from their participation in Meta Journalism Project’s U.S. Reader Revenue Accelerators as a catalyst for this primary audience focus. At one point in the program, Grindley calculated the lifetime value of a sustaining donor (a person who signs up to auto-renew their contribution monthly or yearly) versus a one-time donor — the result pointed him and the team toward prioritizing sustaining donors above all. The strategy shift has paid off: As of September 2024, Next City has 1,000 sustaining donors, which is twice as many as it had almost two years ago. (Next City’s main tactic to incentivize sustainers has been a “pay what you wish wall” — a prompt for audiences to consider donating after reading three articles, when registering for a webinar or downloading one of the organization’s e-books.)

Chapter 2 will cover more examples of audience growth and engagement tactics.

Challenges and what’s next

Nearly half of the survey respondents listed staff time and financial resources as the two key challenges they face while trying to grow and engage their audiences. Less common primary challenges included organizational strategy and planning, staff knowledge and skills, and attracting and retaining staff.

Defining comprehensive ways to measure the size and scope of audiences beyond pageviews is a key ongoing challenge most cited by outlets in INN’s reporting. Metrics captured in Google Analytics and similar tools are usually limited to on-platform reader behavior, so newsrooms like Next City are looking to industry leaders like The 19th, which is measuring reach across all platforms, and hoping to adopt a similar strategy. An additional challenge is quantifying audience reach for republishing partnerships. Some tools for calculating the reach of a story require a piece of code for the publishing partner to include on their webpage that will help measure its audience, but inconsistent compliance makes it almost impossible to paint a true picture of audience size. Chapter 3 will cover efforts to track and measure direct and third-party audiences.