Executive Summary

Sector expands as resources and capital grow

Growth of the nonprofit news sector can be measured across a variety of indicators, including the numbers of INN members, total revenue, philanthropic revenue, staffing size and audience reach. Collectively, these measures indicate the field is robust, increasing in capacity and influence.

In the past, some observers have wondered whether capital support would increase to match the needs of a growing nonprofit news sector. This year’s revenue estimates suggest that as the nonprofit journalism field expands, the resources to sustain this field are expanding, too.

INN membership saw 17% growth in the number of digital-first news outlets between 2021 and 2022. That growth did not translate into more competition over a static or shrinking pool of resources. We estimate that fieldwide revenue for INN members grew about 19% in the same period, now totalling to just under $500 million.

- Overall staffing numbers are also in line with that rate of revenue and outlet growth, representing a 15% increase in workforce size compared to the previous year. We estimate that INN’s digital-first members employ nearly 4,000 people. Of those, roughly two-thirds (2,700) are editorial staff including reporters, editors and other kinds of journalists.

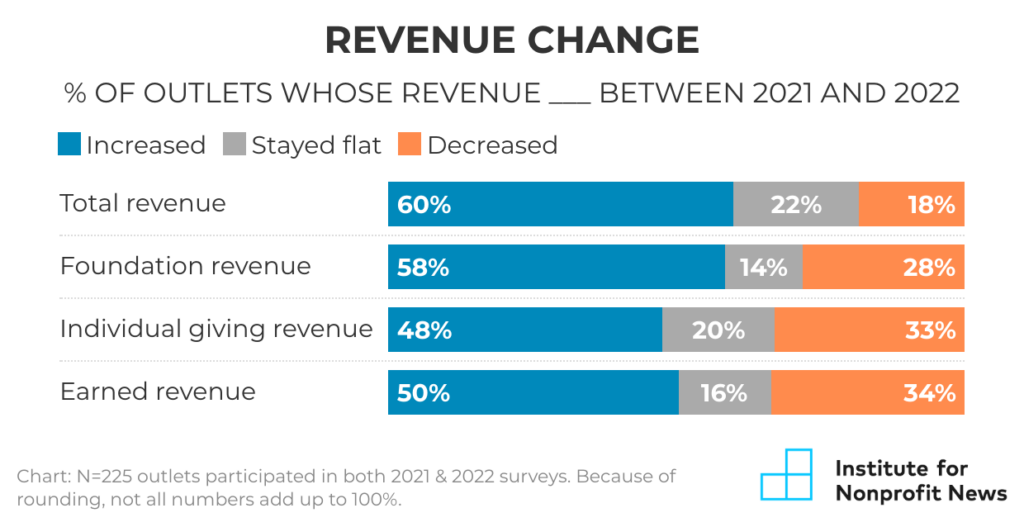

- The growth we are seeing isn’t confined to our larger, more established members, but rather is relatively spread out across the entire field. More than 80% of the outlets surveyed either grew total revenue or maintained revenue over a one-year period (from 2021 to 2022). The data don’t indicate why some outlets experienced growth while a smaller portion saw declines. Outlets in both the growth and decline categories are generally representative of the field as a whole with a mix of local, state and national/global outlets.

60% of outlets in our sample grew total revenue by 10% or more from 2021 to 2022

- A note on public broadcasting: INN’s primarily digital newsrooms account for more than 90% of INN’s membership; however, nearly three dozen public broadcasters are now part of the INN Network. The figures in this report do not include data from our public broadcast members because their organizational structures make it difficult to estimate both the amount of revenue tied to their news operations and the size of their newsroom staff. Nevertheless, if INN’s public broadcasting members were added to these figures, we estimate that total revenue across our membership would be between $600-$800 million, and total newsroom editorial staff could be as high as 3,500-4,200 reporters, editors and other journalists.

Related INN Network Directory