INN Index Snapshot 2023: Growing resources lead to sector expansion

Revenue Growth 2023

Most news outlets grow or sustain total revenue over time

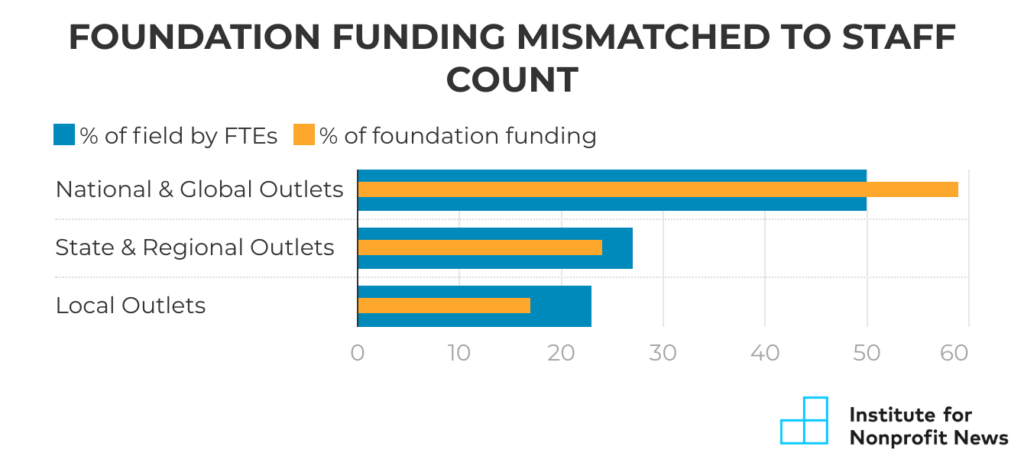

Median revenue per outlet is about $475,000, representing growth from the roughly $370,000 median reported the previous year. State and regional outlets are driving this gain, growing their median revenue by 36% in a one-year timeframe. A major driver: Foundations investing in larger, more established state and regional outlets. Our data don’t explain why foundation support to state and regional newsrooms is growing, but our reporting indicates a shift in philanthropic attention to statehouse coverage.

Local News Outlook

COVID-19 and its related economic forces put a lot of strain on the local news sector, causing widespread contraction and closures in recent years. While this trend has affected commercial newsrooms, nonprofit, digital-first local outlets are expanding in number and growing in capacity. Forty-six percent of outlets surveyed in 2022 focused on local news, up from 42% reported in 2021. About half of surveyed local outlets serve larger communities (defined as a population of 100,000 or more), and half serve smaller communities of 100,000 or less.

More than half of the nearly 100 local outlets surveyed in 2021 and 2022 increased total revenue during this timeframe, with gains reported across all three major revenue streams — foundation funding, individual giving and earned revenue. Both more established local outlets, along with nearly a dozen local startups that launched in 2020, are experiencing this revenue growth. Outlets that saw declines are a mix of large and small organizations, most of them beyond the startup phase.

Community and local foundations are driving some of this revenue growth. Among 132 local outlets that provided revenue data for 2022, nearly two-thirds reported receiving grants from community or local foundations, and four in 10 said that source represented 50% or more of their total foundation revenue. The median contribution from a community or local foundation to a local outlet was an estimated $50,000.

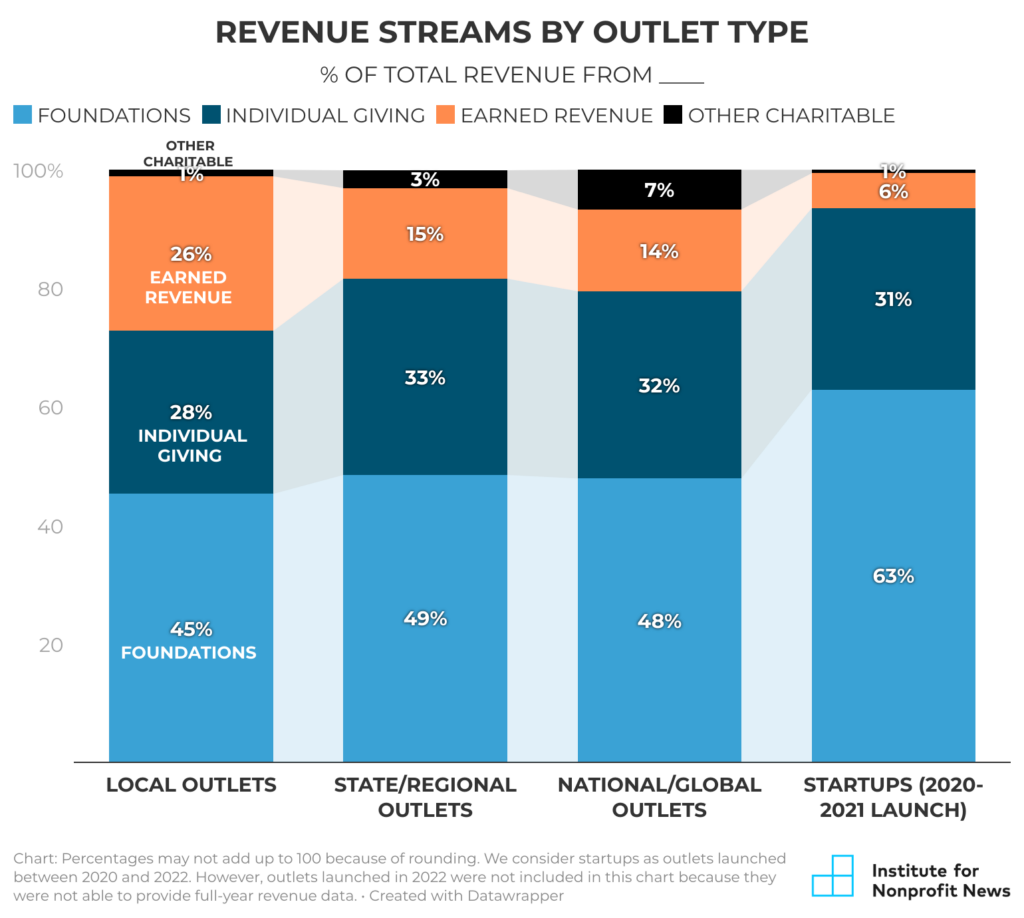

Although local outlets still see fewer foundation funding dollars when compared to those that operate on a national or global scale, we see modest improvements in how the sector’s foundation funding is distributed. Local outlets employ 23% of full-time equivalents employed by survey respondents but receive only 17% of foundation funding dollars reported in the survey. National and global outlets employ 50% of the sector’s FTEs and receive 59% of the sector’s total foundation funding. INN’s DEI Index Report will further analyze foundation funding breakdowns by outlet type.

Local outlets are also regaining some of the advertising and other earned revenue dollars lost during the COVID-19 pandemic. Local outlets grew earned revenue significantly between 2021 and 2022, from $11 million to more than $15 million, a gain of 37% among the 52 outlets that reported earned revenue in that timeframe. Larger, more established local outlets are experiencing the most success regaining earned revenue, with advertising dollars (as opposed to sponsorship and underwriting) largely driving the growth.